There is a standard rate of 6% levied on certain goods and services:

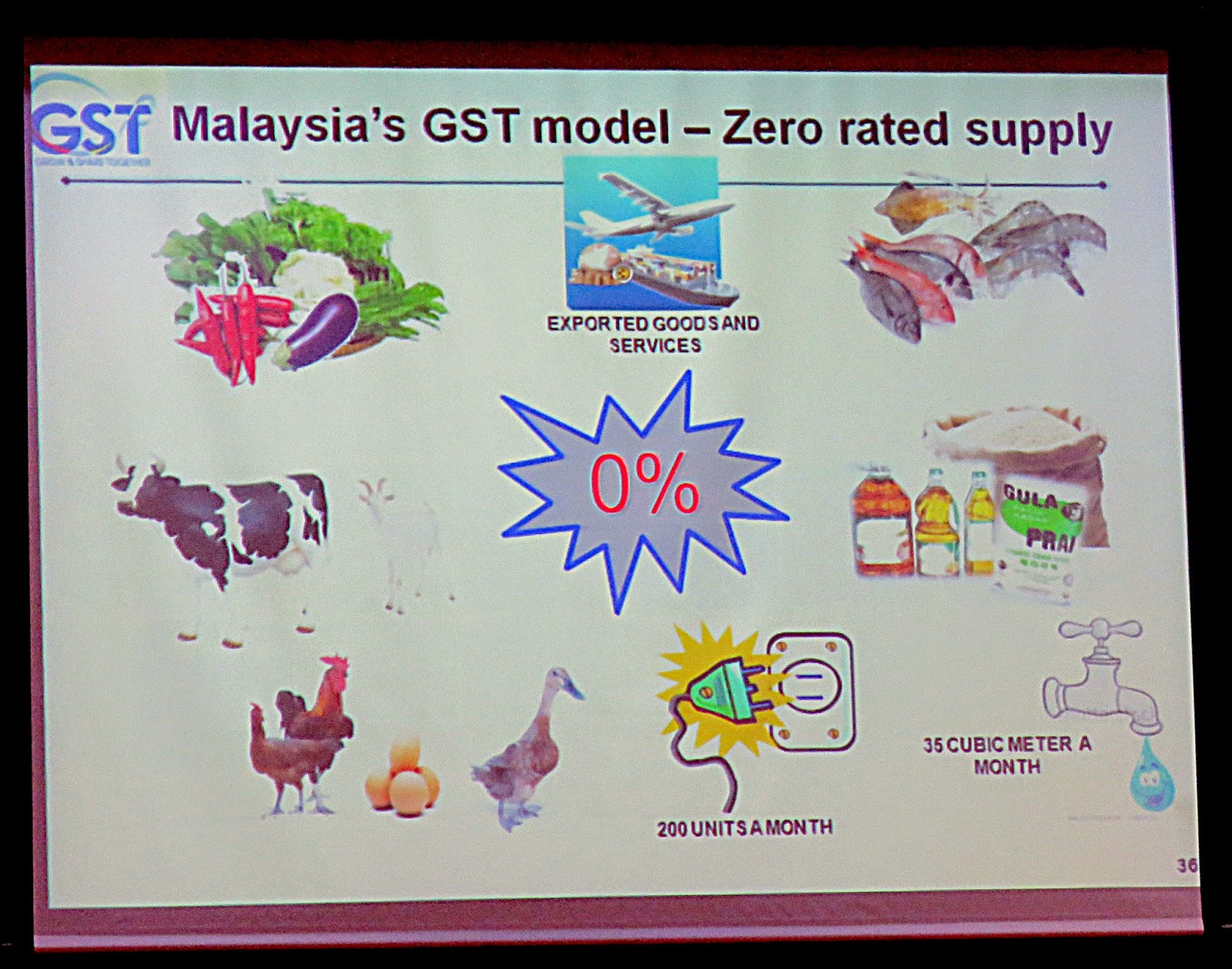

There is zero rate on selected goods and services:

Malaysia's GST Model is based on the following types based on output tax of 6%, 0% and those exempted:

These are the following types of classification for high rise development buildings:

Meanwhile, our apartment building is a mixed development type but classified as a commercial building because the property is built on a piece of commercial land. That is why we are paying commercial rates for water (free from GST for the first 35 cubic meters each month) and electricity charges (free from GST for the first 200 units for each month ).

We have 24 retail units and 400 over residential units. The residential units are exempted from GST but if the total management fees and other charges levied on retail units exceed RM500,000, a 6% GST will be levied on the retail units. At the moment the charges have not exceeded the RM500,000 limit.

Under GST, the 6% GST is paid at source and the retailers at the supply chain will claim tax credits from the Customs Department and should not add on to the initial 6% levied on the goods. Thus, the end-consumer will only pay for the 6% GST but not additional 6% supposedly charged by the retailers in the chain.

However as the JMB has to deal with suppliers of goods and services who will be charged the 6% GST, the extra charges will be transferred to us.

We hope that this information will be useful to parcel owners of eTiara.